The oil and gas industry has undergone a tremendous change over the past year with weak prices and inconsistent demand globally. The oil and gas market drives the gross domestic product (GDP) of several countries, with a number of key end-user industries also dependent on it. Changes in the oil and gas arena have a ripple effect on multiple industries, and investments in this sector play an important role in the progress of various nations. During the last year, the industry has witnessed a drastic fall in oil prices with severe implications such as slowing of investments in new projects. Falling oil prices almost resulted, for example, in the bankruptcy of several shale plays in the U.S.

As oil prices recover over time, a number of factors are expected to shape the future of the oil and gas industry. In upstream oil and gas, increasing focus on unconventional sources is attracting a large portion of the investments across North America, Latin America and Asia. China has one of the largest reserves for shale and is expected to dominate the investment landscape in the Asian region. Although uncertainties regarding accessibility and extraction and production technology remain, many global oil and gas participants are actively looking for opportunities in China. As China looks toward cutting down coal consumption, the successful ventures in shale gas are expected to help China achieve this goal. The Latin American region also has potential in shale gas. As oil companies plan investments in countries such as Mexico and Argentina, this segment is expected to drive the demand for a wide range of equipment along the value chain.

A significant part of the discoverable volume of reserves is offshore, which has led to increased investment in subsea plays. The growing number of subsea projects in regions that include the North Sea, Gulf of Mexico, West Africa, Brazil and Asia is expected to boost pump demand almost 15 percent over the next six years. This growing number is expected to lead to a significant investment in the advancement of subsea technology, and new subsea technology is slowly gaining the limelight.

In midstream infrastructure, planned pipeline construction in 2015 has slipped an estimated 30 percent from forecasts in 2014. Future plans, however, indicate an increased mileage compared with earlier years. Long-term investments in pipeline plans in the U.S., Asia and Africa contribute to the larger portion of the expected plans beyond 2015. The growing demand for natural gas in China is expected to boost construction of liquefied natural gas (LNG) import terminals. In addition, traditional land-based units are coupled with floating storage and regasification units (FSRUs) in China, Russia, Brazil, Colombia and others.

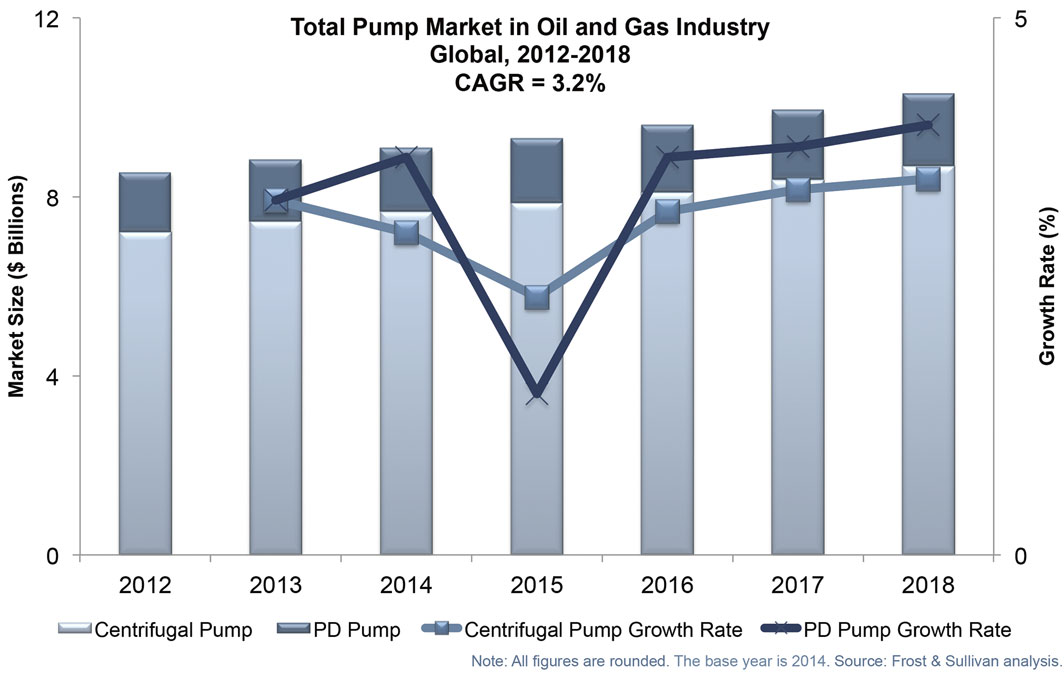

Figure 1. Total pump market in oil and gas industry (Courtesy of Frost & Sullivan)

Another trend in midstream natural gas is the implementation of micro LNG facilities, which are modular setups that require significantly lower investments. In the long term, midstream focus is expected to shift toward these small-scale LNG terminals in order to reduce costs while maintaining safety standards, scalability, flexibility and ease of access to difficult end-user sites.

Downstream investors remain optimistic on the demand/supply scenario, while investment plans in emerging regions continue to rise. Countries in Asia and Latin America witnessed increased investment in the recent past, and, despite the overcapacity in the global market, oil companies continue to invest in China and India.

Recent oil and gas reserve discoveries in East Africa are expected to lead to investments in this region as well. Capacity additions in emerging regions are expected to offset the closures of refineries in Europe. Additionally, the shale boom had resulted in an increased production potential of ethylene fueling the petrochemical industry in the U.S. The investments in these industries have led to a moderate demand for positive displacement (PD) pumps and centrifugal pumps.

Pump Market Analysis

The global pump market in oil and gas stood at a staggering $9 billion market in 2014.

Although the growth rate for pumps is expected to be low during the current year because of the recent weakness in investments in oil and gas, the compounded growth over the next five years is expected to be 3.2 percent. Conventional sources of oil and gas continue to dominate global production, while unconventional sources lead to a higher growth rate in the pump market. A number of factors shape the pump market in oil and gas, including shale production in the U.S., oil sands in Canada, discovery of other conventional reserves in Latin America and deep-water discoveries in Asia Pacific. The upstream sector in oil and gas generated the most revenue for the pump market as significant investments occur in offshore and onshore exploration and production activities.

In this industry, centrifugal pumps are primarily used in midstream and downstream applications across pipelines for transportation, storage and terminals. Some pumps, including horizontal multi-stage pumps, are used for water injection and other treatment applications. Such pumps must be highly engineered based on the specifications required by the oil producers.

Centrifugal pumps typically have lower maintenance costs, are easier to change parts and can be configured easily for different applications in comparison with PD pumps. Vertical turbine pumps are regularly used in booster stations, while in downstream applications the opportunities for sealless pumps are increasing.

Investment in downstream is uncertain in regions such as Europe, while some activity continues in Asia. Regardless, the growth for the pump market is expected to have a moderate demand. Investment in specific pockets of upstream such as subsea will lead to a high growth rate for centrifugal pumps required for water-handling subsea activities.

The growth rate for PD pumps in oil and gas is expected to be low for the current year as a number of projects face postponement in investments. However, because of recovery in oil prices and continuing upstream activities, the growth of PD pumps is expected to recover fairly rapidly. These pumps are used heavily in wells where flow is declining and in places where crude oil may contain sand content. Reciprocating pumps are predominantly used for shale exploration and production in high-pressure applications such as frac pumps. Metering pumps are often used in exploration and production activities as well.

In the long term, the oil and gas industry continues to dominate the energy requirement globally. The current market is expected to continue moderate growth as investments in extraction from more inaccessible locations intensify. These factors are expected to drive the pump market and maintain an active demand from this industry. |